Many reviews of CreditLoan comprise close, praising the business for its secure and rapid provider. Really particularly suitable for anybody planning to acquire a small swelling of cash.

Although the team possess kept higher reviews on most sites, some research demonstrates most adverse buyer product reviews originate from people that happened to be just refused a loan.

Other than this, interest rates and cost terminology happened to be found to be sensible and close. People also got assistance from loan providers to help enhance their credit reports by regularly checking into the monthly payments to credit agencies.

Lots of issue ought to be taken into account whenever selecting a no credit check loan. When you decide on interested in a loan provider for a zero credit assessment mortgage, it is very important choose one keeping this amazing things at heart:

The Quantity You’ll Want To Borrow

The first step to selecting a loan try calculating how much cash needed. Businesses promote financing models starting at $250 and increasing to $10000. But the majority of lenders promote financing of no less than $1000 to $1500.

If you’d like to take a loan lower than $300, it might be better to save instant online payday loans up a little extra cash or query a friend or a close relative for the money. In this way, you won’t need to pay high-interest rate or feel the headache of getting that loan.

Repayment Strategy

Different loan providers need different conditions and terms on whenever and how they need the quantity borrowed to get paid back. Including, some providers offering automated repayments removed from your bank account monthly as a choice. Sometimes, this may even provide a lowered interest.

Often, however, you will have to beginning trying to repay the loan in equal payments after thirty days. Most repayment conditions become between five period and six age. Both the monthly installment and net rates depends from the time of the loan you took.

Interest Rate

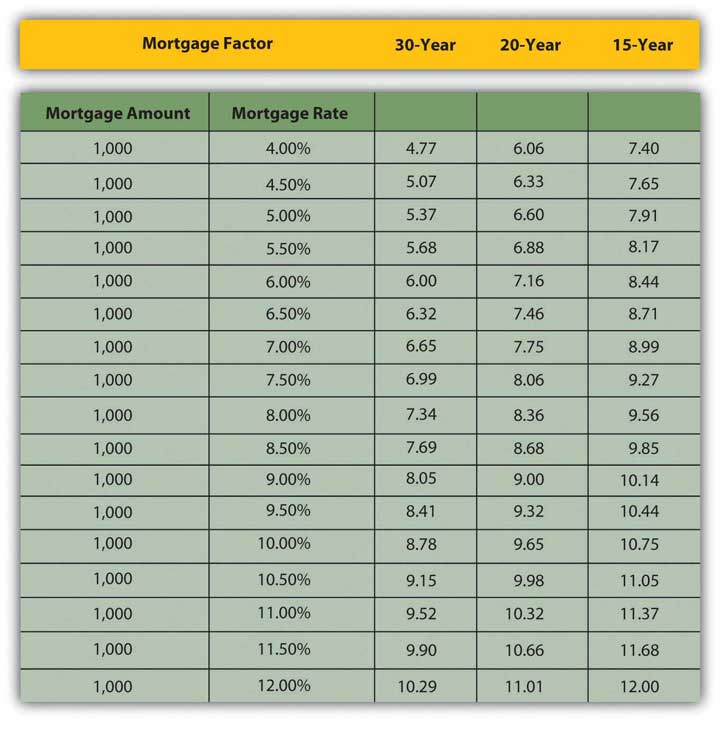

Maybe what is important to consider selecting a loan is the rate of interest. The rate of interest is impacted by a few elements, like loan amount, credit rating, and amount of time necessary for repayment. Companies offer interest rates which happen to be only 4% and as high as 30per cent.

Typically, you may get a beneficial lowest web rate for those who have a great credit history of course you decide on the smallest payment times possible.

Timeframe of Payment

When applying for any personal loans, you receive the option of selecting ideas on how to repay them relating to your hard earned money circulation and earnings amount. Some borrows provide solution of autopay using good thing about lowering the APR by 0.5%.

Some individuals want to have their own equal payments only possible, for that reason deciding to repay the loan in lot of period or some many years. And others prefer to repay it as soon as possible, thus having to pay a low-interest rate but a high monthly payment.

Should you decide on using the longer path, expect you’ll pay high-interest prices on the loan. Once the monthly premiums is lower plus the repayment stage is actually longer, this may perhaps not seem like a great deal, but you will feel paying much more for your financing in the end.

When picking a payment arrange, an over-all rule of thumb is you should take any financing that produce you may spend over 35percent to 45per cent on debt. This consists of auto loans, mortgage loans, and just about every other personal loans. If their monthly earnings is actually $4000, you should keep your debt duties lower than $1700 monthly.