China’s dating online person nevertheless faces complicated problems.

Leo is definitely a technology and buyer items specialized owning sealed the intersection of walls block outpersonals ekЕџi and Silicon Valley since 2012. His own wheelhouse features impair, IoT, analytics, telecom, and games appropriate ventures. Adhere him or her on Twitter to get more detailed updates!

Momo (NASDAQ:MOMO) , the Chinese tech vendor that owns two state’s leading dating programs, recently submitted its first-quarter earnings. Its profits dipped 3.4% year over spring to 3.47 billion yuan ($529.7 million), lost offers by $3.1 million. The tweaked net income declined 14% to 634 million yuan ($96.7 million), or $0.44 per advertisements, which still conquer goals by $0.11.

Momo is expecting its sales to-fall 4.3% to 6.9percent for the 2nd quarter. That dipped in short supply of analysts’ targets for a 4percent decrease, and procedures did not incorporate any bottom-line assistance.

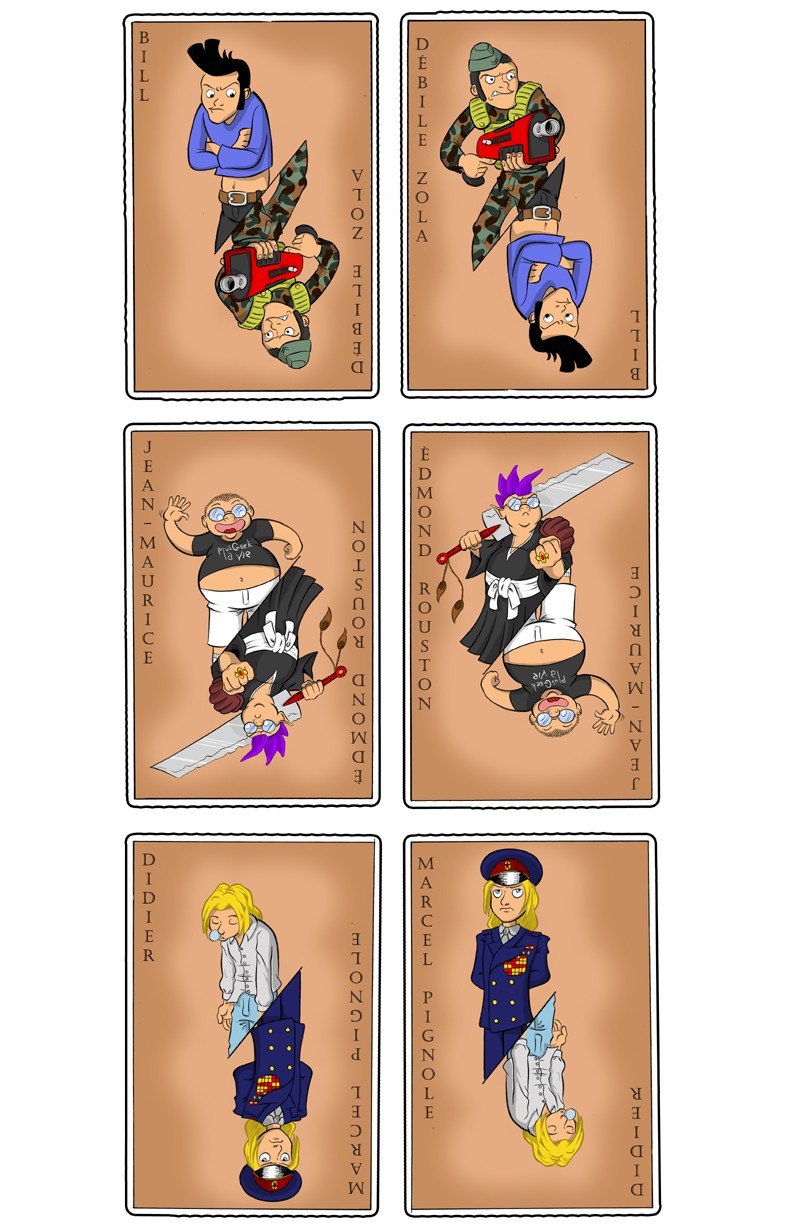

Looks source: Getty Shots.

Momo’s expansion rate check poor, but the stock still state-of-the-art following the review, presumably because profits defeat. The lower onward P/E ratio of 7.7 may also be position a floor under the inventory, specially after they have shed 70per cent of the value within the last several years.

But is Momo inventory in fact worthy of shopping for as a potential turnaround enjoy? Or should investors nevertheless swipe kept regarding the so-called “Tinder of China”?

How Momo destroyed its push

A glance right back at Momo’s decelerating advancement in the last five years explains why the regular possess damaged.

If Momo has gone open at the end of 2014, they generated significantly more than 60 percent of the money from subscription fees on the namesake app. The Momo application allowed owners to obtain associates according to their pages and regions, and paid owners could unlock a lot more characteristics and incentives. It wasn’t explicitly sold as a dating app, but it would be commonly used for the mission. The rest of the sales originated from advertising and the smallest mobile-gaming business.

That transformed into the next fourth of 2015, as soon as Momo founded a live videos web streaming platform for the key application. Model attribute drawn scores of new registered users that purchased digital presents for his or her favorite broadcasters, as well as revenue and pay advancement accelerated considerably throughout 2016.

Momo created 79per cent of its earnings looking at the live streaming organization that year, and also it carried on expanding in 2017. But between 2018 and 2020, three key challenges derailed the business.

1st, China’s live videos streaming market grew to be over loaded with brand-new opponents, many of which tried to draw in leading broadcasters with large revenue-sharing arrangements. Other, Chinese regulators, anxious people cannot censor alive training video avenues quickly adequate, chapped upon the booming markets and banned numerous broadcasters. That crackdown in the course of time pushed Momo and Tantan, the smaller dating app it obtained during the early 2018, to suspend their unique companies for a number of weeks in 2019.

Lastly, people spent less cash on multimedia gifts and superior subscriptions through the pandemic just last year. In addition, Momo improved its owner obtain charges for Tantan, which meticulously resembles accommodate’s Tinder that is unmistakably marketed as a dating software.

Can Momo make a comeback?

From the brilliant area, Momo’s every month effective consumers (MAUs) on the most important app improved 7% season over spring and 1% sequentially to 115.3 million in the first fourth of 2021. Inside convention label, CEO Li Wang attributed that improvement to a “robust data recovery craze” during Lunar new-year.

But the absolute having to pay customers across Momo and Tantan, without keeping track of any overlap, however crumbled to 12.6 million, in comparison with 12.8 million in both the prior and prior-year quarters. Within that complete, their premium users for Tantan dropped 17percent yr over spring and 8per cent sequentially to 3.5 million.

Wang said Tantan had been struggling with the “low efficiency” of its very own individual acquisition initiatives, and streamlining those promotion price throttled its overall owner expansion. To put it differently, Momo’s propose to diversify further alive clips with Tantan hasn’t panned away.

At the same time, Momo’s real time streaming sales decrease 16percent via very first coin mainly because of the mentioned challenges however accounted for 57% of its leading range. That battling organization could still offset the development of Momo’s other paying services for its long run.

Wang alleged Momo obtained off to a “decent head start” in 2021, but it really continue to encounters long-range headwinds. Tencent’s WeChat, the most notable mobile texting application in Asia with 1.2 billion MAUs, continues to be an indirect opposition in online dating. Tencent in addition not too long ago founded numerous matchmaking and stay web streaming applications. Tighter censorship specifications in China also can consistently results Momo and Tantan.

It’s cheaper for apparent reasons

Momo stock might seem like a bargain, but it is affordable because it must over come these types of daunting problems. Experts expect the revenue to stay about level this year as the adjusted pay decline 18per cent, but those dim forecasts could often be as well upbeat in case will continue to drop paying users.